additional tax assessed meaning

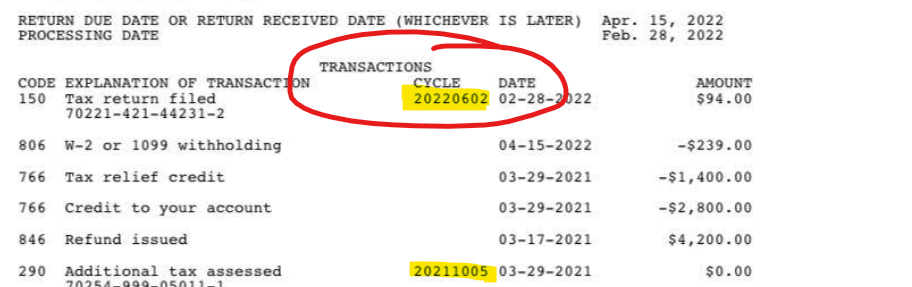

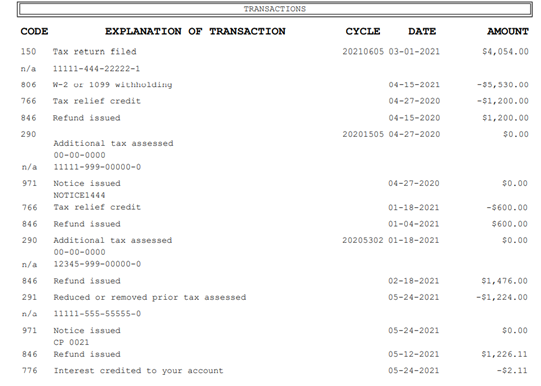

The following is an example of a case law which defines an additional assessment. Keep in mind that there are several other assessment codes depending on the type of assessment Only two of the above transcripts Tax Account Transcript and Record of Account Transcript report the assessment date.

/u-s-tax-filing-1090495926-21c69e6cc0ba4db0894841c99b26adbf.jpg)

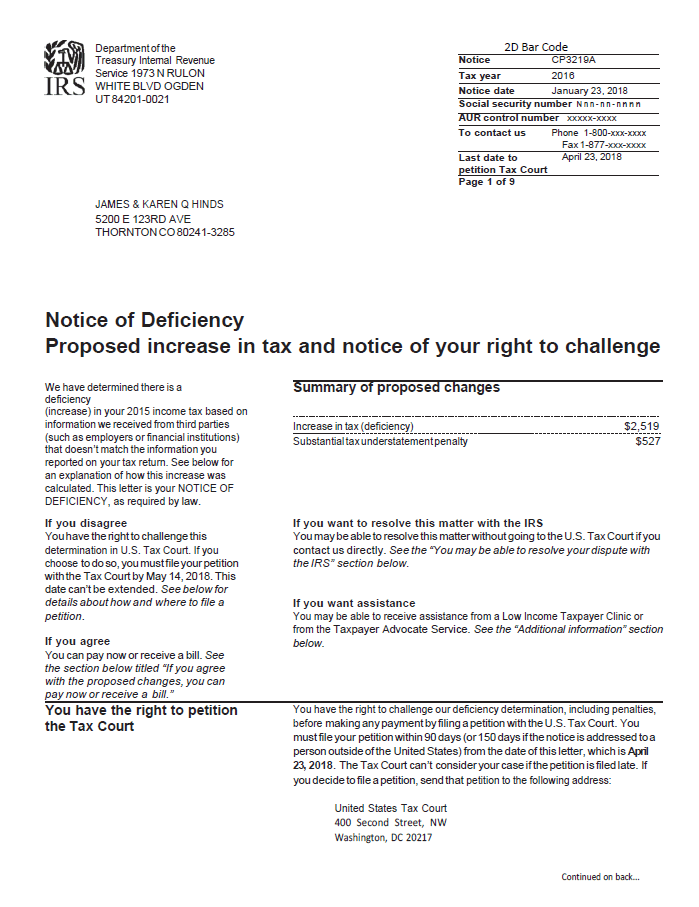

Notice Of Deficiency Definition

A tax assessment is a number that is assigned by the taxing authority of your state county or municipality depending on where the property is located as the value of your property.

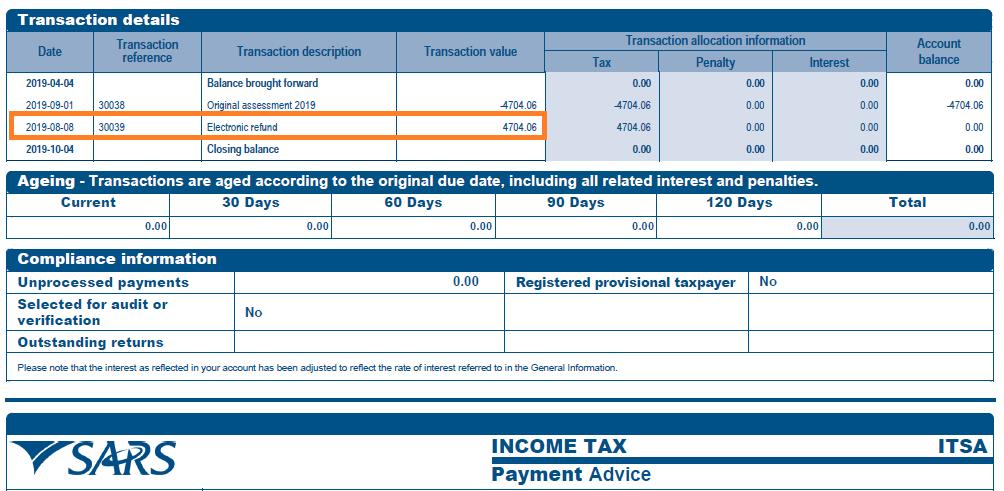

. In the context of the Income Tax Act as it is prior to the coming into force of the Tax Administration Act so-called additional tax which was levied in terms of the to-be-repealed Section 76 of the Income Tax Act on a taxpayer who had made default in rendering a return or who had omitted amounts from his return or had made an incorrect statement in his return. These adjustments usually occur when the IRS receives information regarding income that was not reported on the tax return. Additional tax assessed basically means that IRS did not agree with the original amount assessed and increased the tax you owe.

Additional information that may be obtained from this transcript is the date and amounts of additional payments made by the taxpayer penalties that were assessed and if the return was previously. You can request Wage and Income Transcripts from IRS httpwwwirsgovIndividualsGet-Transcript and compare the numbers reported to IRS. Explanation 1 to section 234B of the Act explains the meaning of assessed tax as follows.

Two of them for this filing. Additional tax as a result of an. From the cycle 2020 is the year under review or tax filing.

I phoned them after a couple of days because they said that I will receive a notification within 48 hours which I did not. When additional tax is assessed on an account the TC is 290. Additional Assessment Law and Legal Definition.

Possibly you left income off your return that was reported to IRS. You understated your income by more that 25 When a taxpayer under reports his or her gross income by more than 25 the three-year. Additional assessment is a redetermination of liability for a tax.

In any event whatever the reason for the adjustment youll receive a notice that explains it. Approved means they are preparing to send your refund to your bank or directly to you in the mail. The term additional assessment means a further assessment for a tax.

What is a additional assessment from SARS. The Code 971 on your 2020 transcript was probably the letter you got from Trump back in April. As to why it was done there is absolutely no way for me to even guess without looking at the transcript and understanding all of the details of your case.

It is a further assessment for a tax of the same character previously paid in part. Accessed means that the IRS is going through your tax return to make sure that everything is correct. No dependents or write-offs.

Means any assessment demand or other similar formal notice of a tax liability issued by or on behalf of any Tax Authority by virtue of which the Company either is liable to make a payment of tax or will with the passing of time become so liable in the absence of any successful application to postpone any such payment. Just sitting in received. 575 rows Additional tax assessed.

This triggers a 3219A notice that explains everything. The property tax rate also called a multiplier or mill rate is a percentage expressed in decimal form by which the assessed value of your. This number is called your tax assessment.

Advance tax paid was Rs 120000. Let us understand computation of section 234A of the Act by this simple illustration. A normal 2020 transcript for someone eligible for both stimulus checks will look something like the following dates might be a bit different if you got a check or a prepaid card instead of direct deposit.

In simple terms the IRS code 290 on the 2021 tax transcript means additional tax assessed. The 20201403 on the transcript is the Cycle. I did my eFiling as usualthen I got a ITA34 which said that they owe me money then they requested that I give them the supporting documents which I handed in at the SARS offices.

If that occurs the IRS generally has 60 days from the receipt of the return to assess additional tax. It means that your return has passed the initial screening and at least for the moment has been accepted. This usually happens when SARS disallows some of your expenses and therefore issues an Additional Assessment showing the extra tax that is due.

To Pay Tax Penalty 272 IBA Failure to Pay Penalty Restriction Deletion 276 IB D Failure to Pay Tax Penalty 277 IB C Abatement of Failure to Pay Tax Penalty 280 IB D Bad Check Penalty 281 IB C Abatement of Bad Check Penalty 286 IB D Bad Check Penalty 287 B C Reversal of Bad Check Penalty 290 IB D Additional Tax Assessment. Is the message something to be concerned about. None of the above transcripts provide the CSED.

It may mean that your Return was selected for an audit review and at least for the date shown no additional tax was assessed. The assessment is multiplied by the tax rate and that is how your annual tax bill is calculated. Just noticed on my transcript additional tax assessed 000 right around the time i filled in Jan.

Code 290 is indeed an additional tax assessment. The important issue is whether the balance due claimed by the IRS is correct in your opinion. Here is what you need to know about the sample IRS tax transcript with the transaction code 290.

Meaning pronunciation translations and examples. Suppose the tax liability of an Individual Assessee was Rs 540000 while tax deducted at source was Rs 340000. The number 14 is the IRS Cycle Week.

I was accepted 210 and no change or following messages on Transcript since. The meaning of code 290 on the transcript is Additional Tax Assessed. Tax is an amount of money that you have to pay to the government so that it can pay for.

Additional Assessment this means more tax is due If however SARS is of the view that your supporting documents do not match your tax return they may issue you an Additional Assessment.

Faq Can I See My Refund Amount And Payment Date Or The Payment Due Date Of The Amount Owed By Me To Sars On Efiling South African Revenue Service

/GettyImages-1042505068-d5c7b095f4704a5286a5cabcc25f4495.jpg)

Your Property Tax Assessment What Does It Mean

Irs Code 290 Meaning Of Code 290 On 2021 2022 Tax Transcript Solved

Sample Rural Property Tax Notice Province Of British Columbia

2022 Refund Schedule And Direct Deposit Payment Dates When To Expect Your Irs Tax Refund And Latest News And Updates On Refund Processing Delays Aving To Invest

Secured Property Taxes Treasurer Tax Collector

Assessments Under Income Tax Act 1961

Ad Valorem Tax Overview And Guide Types Of Value Based Taxes

Income Tax Notices How To Check Income Tax Notice Online Tax2win

How To Respond To A Notice For Reassessment Of Income U S 148a Of I T Act Business Standard News

Types Of Income Tax Assessment Objectives Time Limits Legalraasta

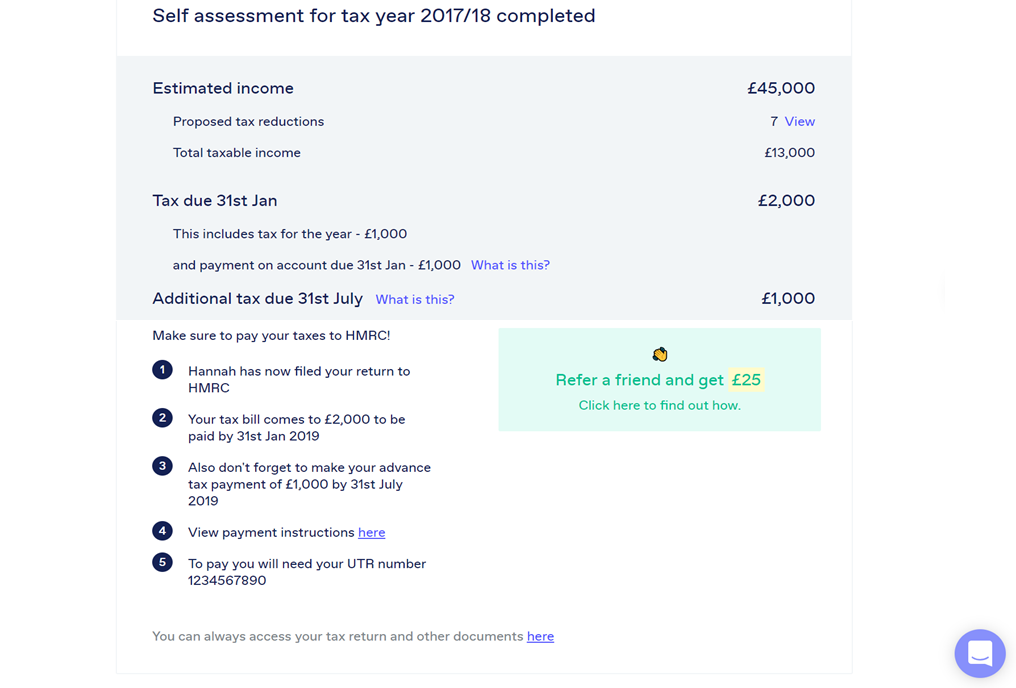

How To Check If Hmrc Has Received Your Tax Return Taxscouts

Irs Code 290 Solved What Does It Mean On 2021 2022 Tax Transcript

Irs Code 570 Solved What Does Code 570 Mean On 2022 Irs Tax Transcript

Nta Blog Decoding Irs Transcripts And The New Transcript Format Part Ii Taxpayer Advocate Service

Notice Of Deficiency Overview Irs Forms Options

![]()

Irs Code 290 Solved What Does It Mean On 2021 2022 Tax Transcript